TSLA Tesla Inc Profile

Content

Tesla’s Earnings per Share for the trailing twelve months ended in Dec. 2022 adds up the quarterly data reported by the company within the most recent 12 months, which was $3.62. The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock. It’s packed with all of the company’s key stats and salient decision making information. Including the Zacks Rank, Zacks Industry Rank, Style Scores, the Price, Consensus & Surprise chart, graphical estimate analysis and how a stocks stacks up to its peers. Tesla, Inc. is an American company that manufactures and sells electric cars, as well as power storage and photovoltaic systems. The company’s goal is to “accelerate the transition to sustainable energy”.

- These returns cover a period from January 1, 1988 through February 6, 2023.

- Bloomberg The Open Jonathan Ferro drives you through the market moving events from around the world on Bloomberg’s The Open.

- Tesla, Inc. designs, develops, manufactures, sells and leases fully electric vehicles and energy generation and storage systems, and offer services related to its products.

You can read more about the power of momentum in assessing share price movements on Stockopedia. In the last 12 months, Tesla had revenue of $81.46 billion and earned $12.56 billion in profits. Investors need to be aware that the PE Ratio can be misleading a lot of times, especially when the underlying business is cyclical and unpredictable.

REG – Stock Exch Notice – Admission to Trading – 23/03/2023

The company name is based on the physicist and inventor Nikola Tesla. Tesla’s recently announced price cuts might help Tesla, but they aren’t doing the electric vehicle market any favors. And now accounts for about 35% of the market cap of all auto makers in the world.

Today, probably Mohnish Pabrai would best reflect my philosophy of favoring undervalued, while not outright ignoring generational growth opportunities. I have been self-employed my entire life and for the last several years, have been investing full time. Prior to that, for 6 years I ran an online business in the credit card space. While running that business, the cash flow coming from it afforded me the opportunity to make high risk, high reward investments in private biotech companies. While the vast majority of what I buy may be considered boring, I do make investments in some highly speculative stocks.

Commercial Vehicle

This is where it is different from the PB Ratio , which measures the valuation based on the company’s balance sheet. During the past 12 months, Tesla’s average EPS without NRI Growth Rate was 122.10% per year. Tesla, Inc. has a trailing-twelve-months P/E of 50.97X compared to the Automotive – Domestic industry’s P/E of 10.62X.

- So yes, based on sales, Tesla is correctly categorized as being an automaker.

- I convinced my grandpa to co-sign the account, despite the fact that he nor anyone else in my family owned stocks or any other investments .

- Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

- Its trailing 12-month earnings per share of 3.24 does not justify the stock’s current price.

- For example, if a company earns $2 a share per year, and the stock is traded at $30, the PE Ratio is 15.

- There isn’t necesarily an optimum PE ratio, since different industries will have different ranges of PE Ratios.

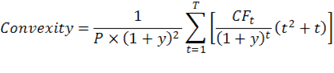

The stock’s EV/EBITDA ratio is 36.16, with an EV/FCF ratio of 84.29. For Shiller PE Ratio, the earnings of the past 10 years are inflation-adjusted and averaged. Since it looks at the average over the last 10 years, Shiller PE Ratio is also called PE10. There are at least three kinds of PE Ratios used by different investors.

Quotes & News

Cheaper EV model, robotaxis, and a new Master Plan are expected by analysts at today’s event. Tesla has announced price cuts to some of its EV models in the US. Tesla stock has a sky-high valuation, much to the delight of bulls and the disgust of bears. Tesla reported 57.23 in PE Price to Earnings for its fourth fiscal quarter of 2022. Gross margin is 25.60%, with operating and profit margins of 16.76% and 15.41%.

The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank. Stock prices are delayed, the delay can range from a few minutes to several hours.

They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

Most would agree the decline is not just macro, as the Twitter distraction and Musk’s political statements are weighing heavily on the price. Dow Jones Industrial tesla pe ratio Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. Gear advertisements and other marketing efforts towards your interests.