Content

You should create AAIs for each unique combination of company, transaction, document type, general ledger class, and cost component. Labor Variable O/H Enter a rate or percentage, as determined in the manufacturing constants, that the system uses to calculate the standard What Is A Cost Sheet? Definition, Components, Format cost for variable labor overhead. For extra costs, the system can calculate the net-added value by multiplying a rate and factor. If you enter both amounts, the system multiplies the two numbers to calculate the net-added cost for the cost component for that item.

- To determine the prices of products produced by the company, it is worthwhile for one to know the difference between cost sheet and production account.

- Eric works for a public accounting firm and has passed his CPA exams with an average score of 94.

- It is possible when cost of goods consumed and expenses of production are given.

- Less production will cost fewer expenses, and vice versa, the business will.

- Brianna has a masters of education in educational leadership, a DBA business management, and a BS in animal science.

- Repairs, depreciation and insurance of office building, furniture and equipments.

By separating the costs, a company can better understand how much they spent on each unit per product produced. During the budgeting process, we will estimate the total cost of each identified activity. For each activity, we will identify a cost driver and estimate the total activity level expected for the period.

8.3 Forms Used to Assign Values to User-Defined Cost Components

Unlike Production account which is prepared after the completion of the production process. Works cost or Manufacturing cost is increased by office and administrative expenses. Needless to say there will be no necessity then to do anything further about work-in-progress. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

- Set up work centers and select the Cost by Work Center option in the manufacturing constants if you want to track cost information by work center.

- The system cannot calculate cost buckets 1 and 2 based on the routing, because extra costs are not related to a particular operation on the routing.

- This metric helps you to know the overall production value of an item based on the resources committed to it.

- Lean accounting is an extension of the philosophy of lean manufacturing and production, which has the stated intention of minimizing waste while optimizing productivity.

- Office and administrative overheads includes those expenses which are concerned with the management of office, administration, finance and other arrangements.

- As cost sheet is nothing but a memorandum statement, it is not prepared as per double entry system of bookkeeping.

In addition to prime cost it includes works or factory overheads. Factory overheads consist of cost of indirect material, indirect wages, and indirect expenses incurred in the factory. Factory cost is also known as works cost, production or manufacturing cost. Production Account is something that integrates into itself, the components of cost sheet and the trading and profit and loss account. It not only includes the total cost of production but also accounts for the selling and distribution overheads.

Cost Sheet Format- Full detail

These activities are also considered to be cost drivers, and they are the measures used as the basis for allocating overhead costs. Examples for a computer maker include the plastic housing of a computer, the face of the monitor screen, the circuit boards within the machine, and so forth. Minor materials such as solder, tiny strands of wire, and the like, while important to the production process, are not cost effective to trace to individual finished units. These costs are termed “indirect materials.” Indirect materials are included with other components of manufacturing overhead, as discussed below. Are materials used in production but not traced to specific products because the net informational value from the time and effort to trace the cost to each individual product produced is impossible or inefficient. For example, a furniture factory classifies the cost of glue, stain, and nails as indirect materials.

Generally, the cost of these unfinished units include direct material, direct expenses, and factory overheads. Further, the cost sheet should give ‘cost-per unit’ in the previous period also, if available, for the purpose of comparison. Opening and closing block of finished goods may be put in a subsidiary statement, which together with the total cost of production and sales will reveal profit. Cost sheet is a statement, which shows various components of total cost of a product.

Difference between Cost Sheet and Cost Account

It includes salary paid to managers, cleaning staff, security staff, drivers, etc.

- Business unit and a subsidiary can also be supplied in the AAI table or supplied by default from other sources.

- A job cost sheet is a document or record that compiles all of the costs that go into a particular job.

- The classification of cost is done on the basis of elements of cost, functions and behaviour of cost.

- In contrast to general accounting or financial accounting, the cost-accounting method is an internally focused, firm-specific system used to implementcost controls.

Accounting cost quantities represent the standard quantity of a work order or rate schedule for this item. During cost rollup, the system divides the fixed costs by the accounting cost quantity that you specify to determine a per unit fixed cost. You can group similar cost components for review and reporting purposes. For example, you can define A1 and A2 cost components as Purchasing. You do this by assigning them the same sequence number in the Description 2 field.

On the basis of such percentage, the amount of profit is determined. The cost of direct materials can be estimated by multiplying the quantity required for a unit of output by the probable purchase cost of materials. Purchase cost of materials will be estimated in the light of future changes in market conditions. It helps in the preparation of statement of profit and loss with the cost sheet for a particular period. It also makes possible to calculate the per unit cost and the total cost on standardized basis for comparative study.

Use this method when you do not want to revalue on-hand inventory when the work orders are completed, but at a different time. Add Work Order Completions and Variance Journal Entries for actual costing.Cost Method (40/CM)Define the cost methods that are used to calculate costs for all items. Codes 10 through 19 are reserved for use by the JD Edwards EnterpriseOne system from Oracle.

If the output or production in units is not given in the problem, then, per unit column need not be taken in the cost sheet. However, the modern practice is to extend the cost sheet to show profit and sales also, and call it ‘statement of cost and profit’. Cost accounts are kept for accounting period as a whole and are prepared when the production is completed. A cost sheet is prepared for a specified period of time, generally for a month, quarter, half year or year. Should you bother about creating a cost sheet as a small business? It’s a wise move to track your resources and see how everything adds up during production.

Thus, it saves the manufacturer from losses which arise due to injudicious fixation of prices without looking to the cost of production. It discloses the total cost as well as the cost per unit of output and provides for the comparison of costing results of a particular period with any of the preceding periods through comparative columns. In short, it is a statement prepared on memorandum basis and does not form part of the double entry system in cost accounts.

Sometimes, percentage of each item to total cost is also shown. When the particulars of a cost sheet are presented in the form of an account, the same will be called a production account. If a cost https://quick-bookkeeping.net/retained-earnings-formula/ sheet shows the total cost and cost per unit, production account shows profit or loss, besides cost. Under an activity-based costing system, we identify four activities that make up overhead costs.

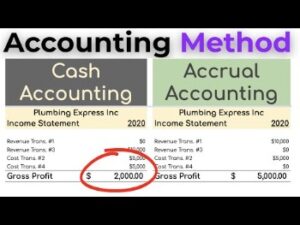

![]()

For example, the electricity needed to run production equipment typically is not easily traced to a particular product or job, yet it is still a cost of production. As a cost of production, the electricity—one type of manufacturing overhead—becomes a cost of the product and part of inventory costs until the product or job is sold. Fortunately, the accounting system keeps track of the manufacturing overhead, which is then applied to each individual job in the overhead allocation process. In a cost sheet, opening stock of raw materials is shown first. Thereafter, purchase of materials, carriage inward, import duty, etc. are added to it and closing stock of raw materials is deducted there from end result “ cost of materials consumed”.

Leave a Reply